Your solicitor-checked online will in 3 easy steps

A Digital Will for Life

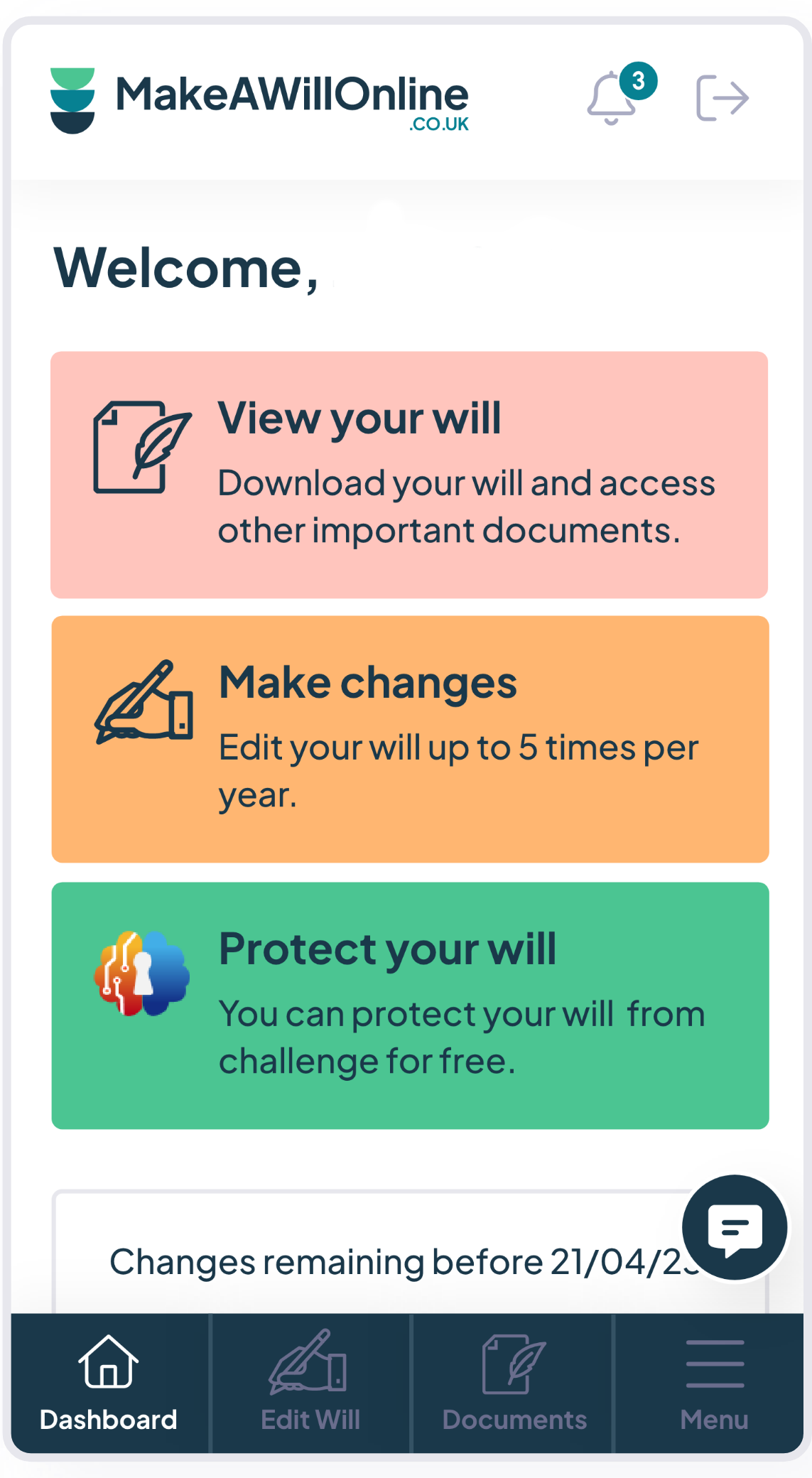

Updating your will

Log in and make changes to your will for 28 days for FREE or choose lifetime updates for just £10 a year.

Once you have started making a will online, you can sign in and continue at a time that suits you. You will find full guidance throughout the process, explaining all of the important legal terms relating to wills and probate.

When you have finished making your will online, you can login and make free changes to the document for 28 days. For even more peace of mind, our optional lifetime updates service (just £10 per year) allows you to keep your will up-to-date forever.

Get Started

Why choose our

will writing service?

With Make A Will Online, you get the peace of mind of knowing a solicitor has checked your will. Anyone can call themselves a “will writer” or offer a “legal check”. A solicitor, on the other hand, is a qualified legal professional. We believe that this offers you the best possible peace of mind for the best price.

We are the only online wills provider to offer this service and were granted an Innovation Space Waiver by the Solicitors Regulation Authority to do so. The success of services like ours led to a rule-change in 2019 allowing the public wider access to solicitors.

| Make a Will Online | Traditional Solicitor |

Will Writer |

|

|---|---|---|---|

| Single will | £60.00 | £200.00 | £100.00 |

| Pair of wills | £90.00 | £350.00 | £170.00 |

| Solicitor check | Yes | Yes | No |

| Insurance | Yes | Yes | Unknown |

| Lifetime updates | Yes | No | Unknown |

| Money back guarantee | Yes | No | Unknown |

| Available 24 / 7 | Yes | No | Unknown |

British Wills & Probate Awards

We work with dozens of Charities across England and Wales

We work with dozens of charities on their gifts in wills campaigns. If your charity is interested, find out more about a Fundraising Regulator compliant legacies campaign.

Our Other products

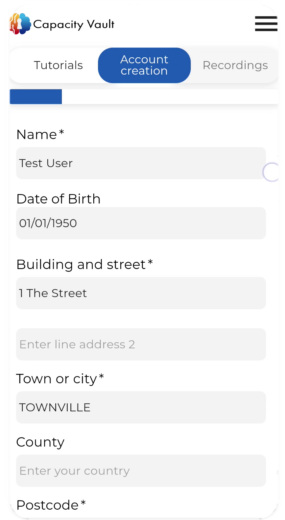

Protect your will

from challenge with

Capacity Vault

It’s free for users of Make a Will Online.

Capacity Vault lets you make a secure digital record of your testamentary capacity and protect your will from challenge.

Learn MoreMake your will online today…

On the bus, at home or on your lunch break!

Get Started

Frequently Asked Questions

- How does the will-writing process work?

- Has the Solicitors Regulation Authority approved this service?

- Wills for UK Expats

Before you start the will writing process you should have the name and address of anyone you intend to name in the document. Postcodes are useful too, but not essential. You will be sent a link by email in case you need to come back at a later date to complete the will.

We are the only specialist provider of online wills to be given consent by the Solicitors Regulation Authority (SRA) to provide the services of solicitors to the public under their Innovation Scheme. We are not regulated by the SRA but our solicitors are bound by the SRA Standards and Regulations including the Code of Conduct.

Our wills are fully legal in England and Wales, but the situation becomes more complicated if you are resident abroad, or own property overseas.

Different countries deal with inheritance law differently and you should consult an expert on local law in the country in which you live.