Sideways Disinheritance and How to Avoid It

Sideways disinheritance is a term used to explain what happens when a beneficiary misses out on their inheritance because of the remarriage of the person who left a will. This is particularly common with blended families.

How does this happen?

When you marry or form a civil partnership, in almost all cases, your previously wills are revoked. There is an assumption that most, or all, of your estate will pass to your spouse or civil partner under the intestacy rules. Your children will miss out on their inheritance if this happens.

When a married couple or civil partnership couple make wills, it is common for them to make mirror wills. These are wills which are effectively identical to each other, leaving assets to each other, and then on the second death to the same beneficiaries. This is not a problem if the second partner to pass away never changes their will and does not remarry. Of course, that doesn’t always happen, and life for the second partner can bring up some unexpected changes.

Examples of sideways disinheritance

Case 1 – John and Anna – Forgetting to make a new will after divorce and remarriage

John and Anna have been married for 12 years and have two young children together. They made wills leaving everything to each other and then, upon both their deaths, to their children equally.

John and Anna since divorce. John forgets to update his will. He later remarries to Harriet, who has children of her own from a previous relationship. By marrying Harriet, John has revoked his previous will leaving everything to Anna and the children.

John dies without having updated his will. Under the rules of intestacy Harriet inherits all of John’s estate. John’s estate will now pass under the terms of Harriet’s will if she has made one since marrying John, or under her own rules of intestacy – passing to her own children.

John and Anna’s children will not receive anything from John’s estate, despite what John had originally intended.

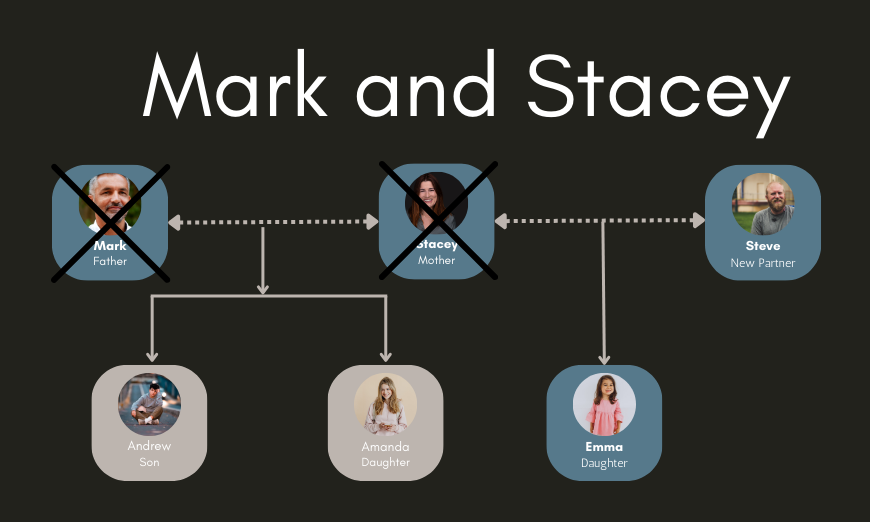

Case 2 – Mark and Stacey – Making a new will after death of first partner

Mark and Stacey are in their mid-30s and are unmarried. They have two young children together. They have made wills leaving everything to each other and then, upon both their deaths, to their children equally.

After a short illness, Mark passes away. Stacey inherits Mark’s estate in accordance with the terms of Mark’s will.

Some years later, Stacey meets Steve. They move in together and have a child of their own. They never marry.

To protect their youngest child, Stacey and Steve make new wills leaving everything to each other and then equally between all three children.

Stacey passes away, and Steve inherits her estate. As Stacey’s eldest children grow up and move out of the family home, Steve decides to make a new will leaving everything to his infant child.

Stacey and Mark’s children no longer inherit anything from either of their parents.

How to prevent sideways disinheritance

-

Update your wills regularly.

Ensure your will is up-to-date after these common life events:

- Divorce

- Marriage

- Birth of a child or adoption

- New grandchildren being born

- Death of a beneficiary

- Death of an executor

- Significant changes in assets

- Serious health diagnosis

- Moving overseas

- Changes in family relationships

For more information on how each of these events can affect your will, read: When to update your will

-

Have open conversations with your loved ones

Discuss your plans and wishes with your partner and loved ones, particularly if any of the above events occur.

-

Consider the use of a trust in your will

Trusts are a useful tool to protect both your estate and your beneficiaries, particularly when it comes to blended families, divorce and remarriage. You should speak with a legal professional to ensure that your wishes are carried out after your death. They can also advise on how you can avoid sideways disinheritance.

This does not cover what is known as a “mutual will”. These types of will contain complex trust arrangements and are highly discouraged due to the problems which can arise after your death. For more information, read our guide here, and seek professional legal advice.

-

Leaving gifts to your children

Make sure that children from both families are mentioned in the alternative arrangements in both wills.